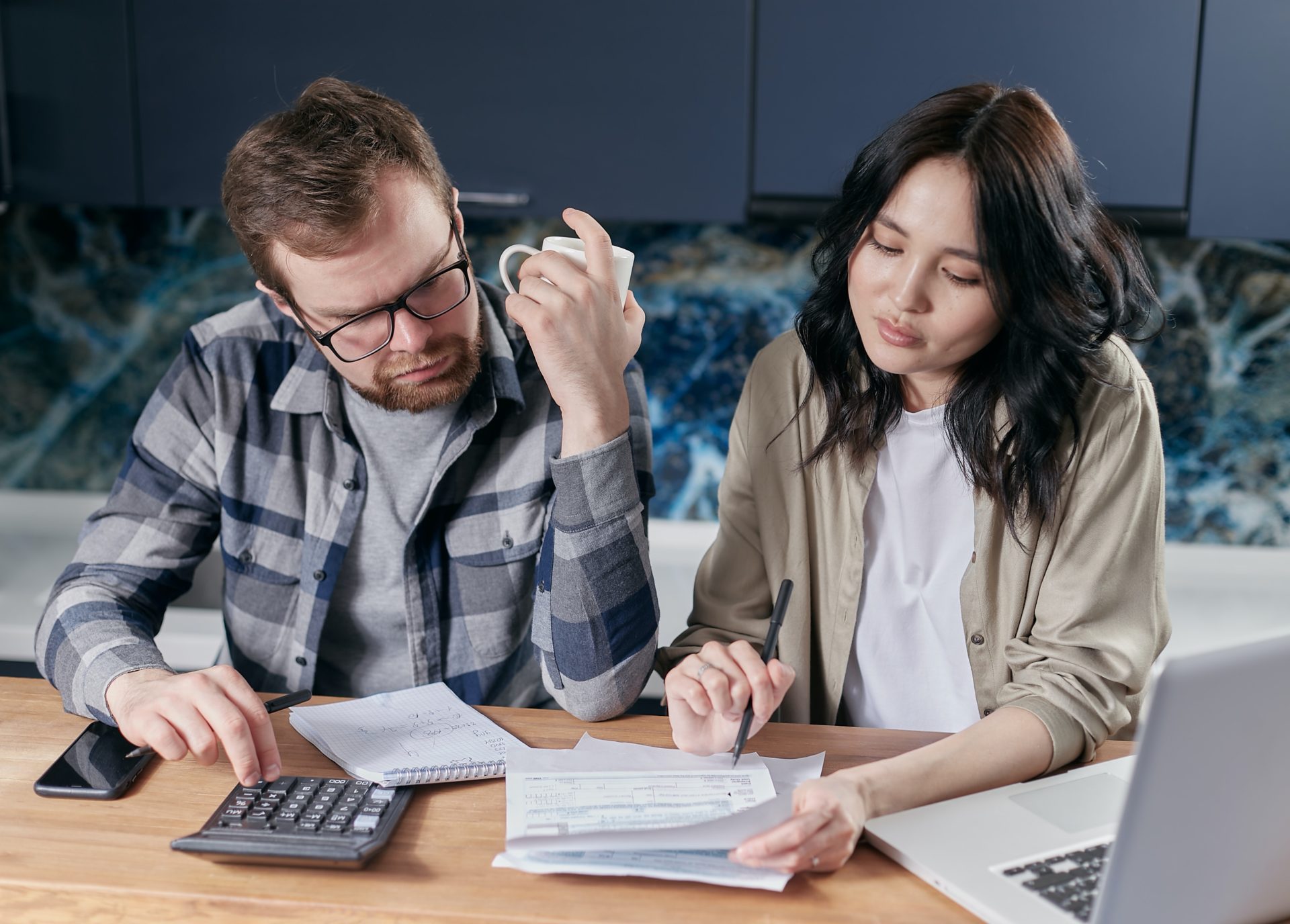

According to Statistics Canada, nearly three quarters of Canadians have some type of outstanding debt. This can be the source of a lot of stress for many families.

One of the problems with paying debts down is that a lot of people try to come up with the ‘big solution’ that will wipe it all away in one swoop. A big solution is fine if you can find one, but sometimes it’s the little things you can do on a day-to-day basis that ultimately make the difference.

Here are 10 small strategies you can start today that can help you on your way to financial freedom.

- Stop adding to the total. Even though it might seem like a very simple concept, you must stop adding to your total debt. If you keep adding while you’re paying, you’ll only go in circles, and you will never make any progress.

- Add extra income. The best way to decrease the amount you are spending on credit each month is to start adding to the total that’s coming in each month. Consider selling items you are no longer using online, work extra hours or even get a second job. Any extra funds you can bring in should be put directly towards your debts.

- Keep a list. Lists are great to get information out of your head and into a more manageable format. When shopping, lists can help you stay focused and disciplined to ensure you buy only what you need.

- Adjust your shopping strategy. If saving money is your goal, then changing up your shopping strategy will also help. Start thinking about buying non-perishables in bulk, stay away from popular brand names, and never go grocery shopping while you are hungry! These kinds of changes may seem trivial, but together they will add up.

- Scrutinize your expense list. Along with your shopping lists, make an overall expense list and scrutinize it closely. Your goal is to figure out which of your monthly expenses are non-negotiable and which ones you can eliminate or reduce. Are four different streaming services necessary at this time?

- Keep track of all your spending. You’ll know where most of the money goes by making and scrutinizing your list, but it’s also important to keep track of every dime you spend for at least a month. You’ll find that you’re spending money each month that you don’t even realize is going.

- Change your focus. If you’re just making minimum payments on each debt each month, you might want to change your strategy and focus on paying the lowest one off completely. Make your regular monthly payments on most of them and pile as much as possible on the lowest one until it’s paid off. Then move onto the next lowest debt and repeat.

- Look for better terms. If you consistently make at least your minimum payment each month, consider asking your creditors to lower your interest rates. If your history with them is good, they might help you out, which will get you to your goals faster. Pick up the phone and ask – you might be surprised what you will be offered. Your bank most likely will have lower options for fees as well.

- Stick with it. Consistency is key while staying with the program. None of the other solutions will work if you are not sticking to your plan. Keeping your focus on the end goal and tracking your progress can be a great help while making these little changes.

- Get some help. You aren’t alone. Sometimes, it’s just that extra little bit that you need to make it all work. Consider contacting a not-for-profit credit counseling agency that can help point you in the right direction.

At SolveYourDebts.com, there are many educational resources to help plan for a successful financial future. Contact us today for a free consultation. Our personalized credit counselling, budget mentoring, and financial education programs are designed to help you solve your debts and feel proud of how you did it.